Trading

Cash flows suggested the idea of events in time. Prior to any cash flowing, however, there must be an agreement between parties to exchange items for money; and a key precondition of any such agreement is for both parties to have the ability to perform some kind of valuation of the items in question. The term value was already introduced, but with a focus on use value (c.f. Definition 2.4) and intrinsic value (c.f. Definition 2.5). We shall now delve once more into this crucial concept, but this time with the aim of extricating a generalisation.

Wikipedia tells us that (emphasis ours):

Definition 2.15: Economic value is a measure of the benefit provided by a good or service to an economic agent. It is generally measured relative to units of currency, and the interpretation is therefore "what is the maximum amount of money a specific actor is willing and able to pay for the good or service"?

It is important to note that economic value is distinct from price, which is instead defined as follows (emphasis ours):

Definition 2.16: A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for one unit of goods or services.

Before we proceed, please keep in mind that this is not the only possible interpretation for these terms. Differing interpretations come bundled as part of a larger body of economic concepts, called theories of value, and these can be quite complex. Nonetheless, these coarse simplifications are quite adequate for our goals, so we needn't explore alternatives 1. Secondly, notice that the key distinction between value and price is that price implies the agreement between parties as part of an exchange; for this reason, price is also known as the exchange value. Last but certainly not least, we should point out the extremely important but somewhat hidden statement that gives a hint to the numeric domain of prices: "usually not negative". We shall not yet go into details of how this can happen, but for now it suffices to say that in some extremely unusual circumstances, one party may be required to simultaneously pay the other party and also supply the product. This is modeled as a negative price, and systems must be designed with this eventuality in mind.

The third concept related to value is cost. By "cost" we mean cost of production, which can be defined as (emphasis ours):

Definition 2.17: Cost of production concerns the seller's expenses (e.g., manufacturing expense) in producing the product being exchanged with a buyer.

Needless to say, determining the cost of production is in itself a very complex subject, but we have chosen to completely ignore these details. The general notion is that there are costs in producing an item, and that those costs will have an influence on the price of the item, though these are two distinct concepts. Alas, "price" is itself a simplified concept. In practice, there are three interlinked notions of "price", all of which are extremely important to Computational Finance (emphasis ours):

Definition 2.18: "Price" sometimes refers to the quantity of payment requested by a seller of goods or services, rather than the eventual payment amount. This requested amount is often called the asking price or selling price, while the actual payment may be called the transaction price or traded price. Likewise, the bid price or buying price is the quantity of payment offered by a buyer of goods or services […].

The traded price is of significance here; the exchange between parties is performed in the context of a trade. Wikipedia informs us that (emphasis ours):

Definition 2.19: Trade involves the transfer of goods or services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market.

The indicative prices that the buyer and seller haggle over are known as quotes, and defined as follows (emphasis ours):

Definition 2.20: A financial quotation refers to specific market data relating to a security or commodity. While the term quote specifically refers to the bid price or ask price of an instrument, it may be more generically used to relate to the last price which the security traded at ("last sale").

Since security is a very important term, we should take this opportunity to define it, as well as the related but somewhat more generic notion of an instrument (emphasis ours):

Definition 2.21: A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages the term "security" is commonly used in day-to-day parlance to mean any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition.

Definition 2.22: Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver […].

With this, the basic vocabulary has been established. All of these moving parts can now be assembled together to form an overall picture in the following manner. A seller, that is, a party with items to sell, comes up with a valuation for the items — called the asking price or just ask; a buyer, that is, a party wishing to buy items, also has its own valuation — called the bidding price or just bid. They come to a market to conduct their negotiation. If the buyer and the seller can agree on terms, a transaction is made — called a trade or a deal. Prices are generally quoted in currency units. In the domain of Computational Finance, the items of interest are financial products, also known as financial instruments, and the markets in which these are traded are called financial markets. The term financial is often omitted for brevity.

There is one wrinkle in this picture. In a typical public financial market, not all parties are able to make prices. That is, the buyer normally does not tell the seller directly its asking price, as you would when you are conducting an informal negotiation at your local market. Instead, there exists a group of privileged entities who are responsible for quoting both sides of a price, making what is known as a 2-way price — i.e. providing both the bid and the ask at which they are willing to transact. These are known as market makers and their role is defined as follows:(emphasis ours):

Definition 2.23: A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid–ask spread, or turn. The U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price.

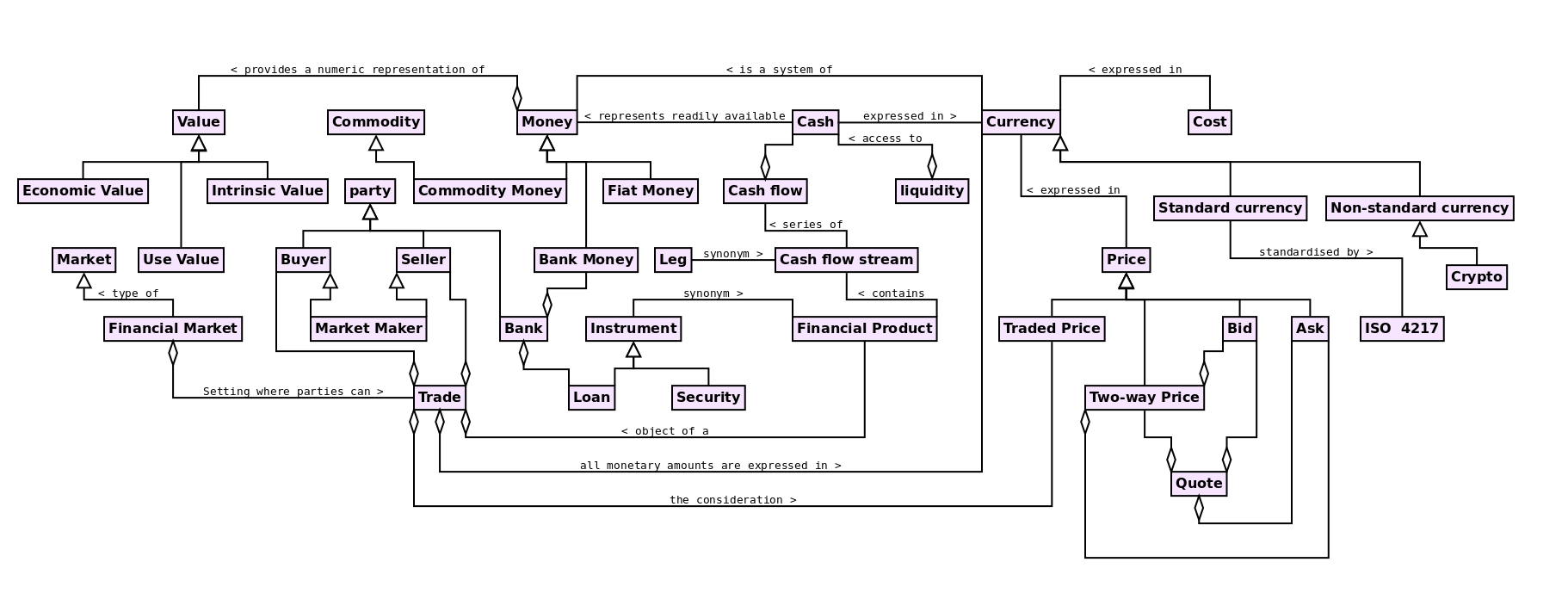

Figure 1: UML diagram of domain concepts.

Figure uml_domain_concepts puts together all of the concepts we've introduced and, with it, we complete this part's domain survey. Next, we shall round up this information by placing it in a broader, and somewhat more philosophical, context.

| Previous: Cash | Next: Finance and Modeling | Top: Domain |

Footnotes:

They can, of course, be entirely unsuitable for other purposes, so they must be used with care outside of our simplified world.